By Rachael Pfenninger, director of strategic execution, AMBA

The year is 2025, and President Trump has ordered additional tariffs across the board on goods from Canada, Mexico and – most crucially – China. At the time of publication, only the additional 10% tariff had been placed on China, while Canadian and Mexican tariffs each are pending further negotiation. This complicates matters for US mold builders because, while some industries – like defense and aerospace – continue to boom, others – like automotive and consumer products – are more uncertain, as their destinies are tied to the various tariffs or other government regulations that may or may not be put in place.

These changing conditions mean that many domestic mold manufacturers must consider changing with them. Whether that means finding new ways to reduce overhead and improve profitability or pursuing new customers and/or new market opportunities, it all must be considered alongside other existing challenges, like continuing foreign competition and the need to attract and develop an untrained workforce.

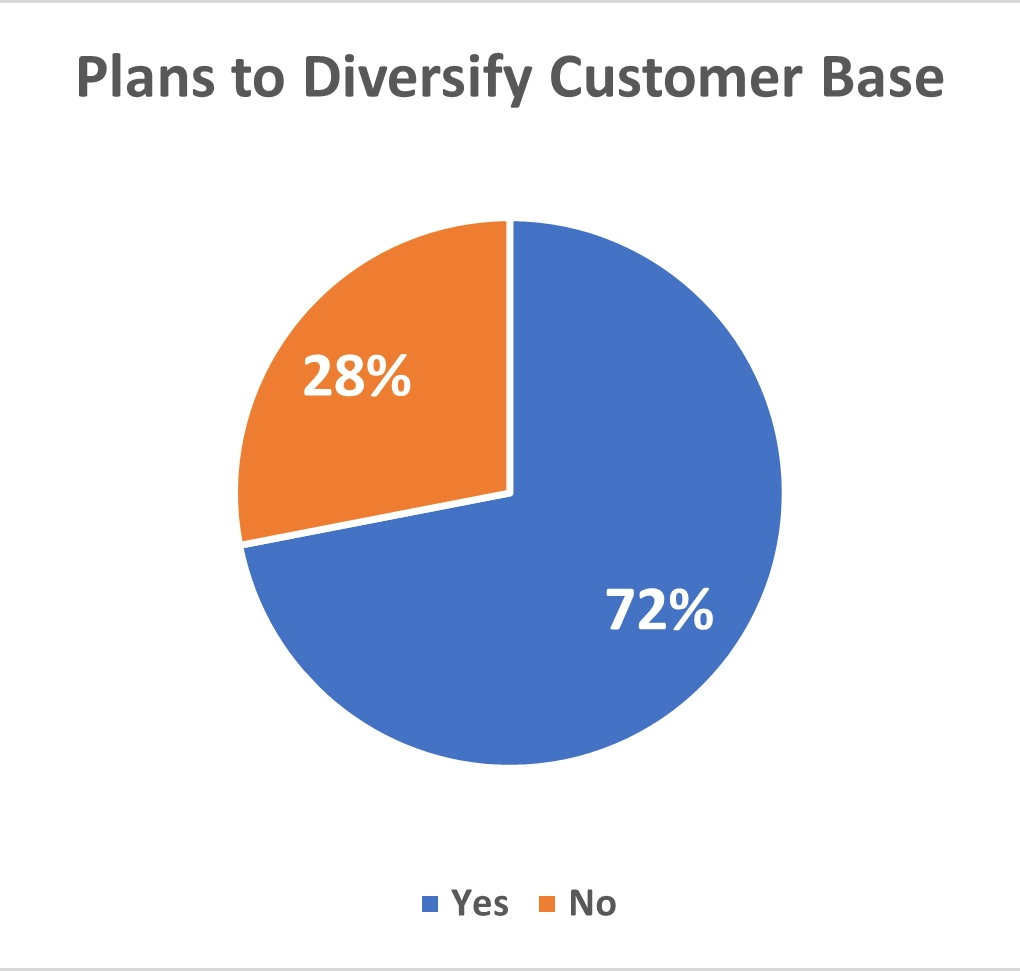

Data from AMBA’s recent 2025 Business Forecast Report, which gathered inputs from nearly 80 US mold manufacturers from early December 2024 to late January 2025, points to these many considerations of today’s industry executives. For example, while the automotive, consumer products and medical/dental/optical markets continue to be those most served by report respondents, a whopping 72% of respondents are considering diversifying into new markets – specifically, aerospace/aircraft and defense/military (Chart 1).

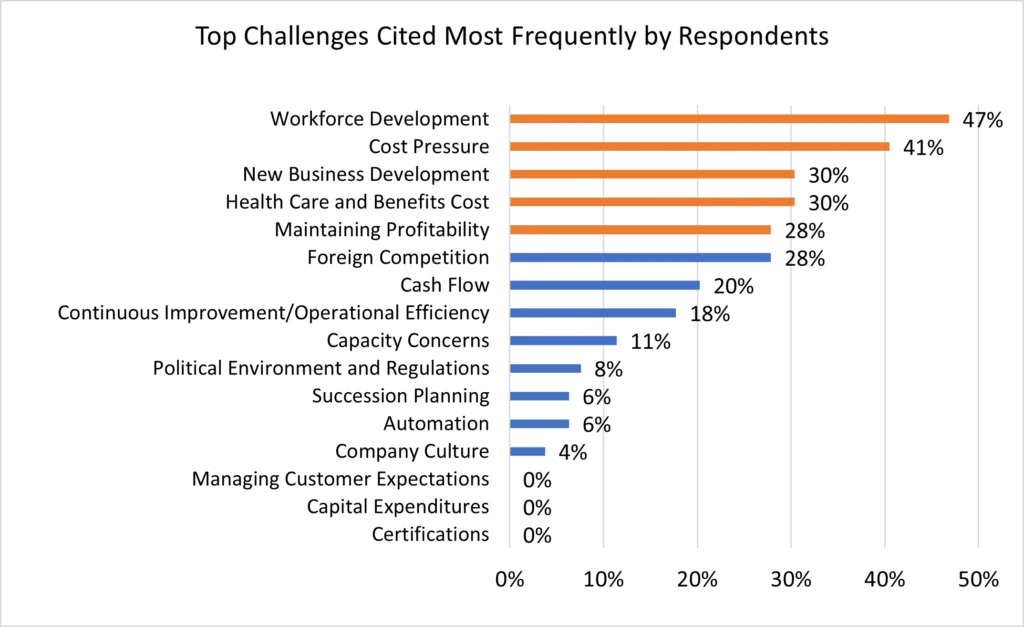

Although foreign competition, healthcare and benefits costs and new business development are weighing heavily on US mold manufacturers, workforce development and cost pressure continue to be the biggest challenges for the industry (Chart 2). Despite identifying these challenges, when asked what single major activity is planned to improve company competitiveness in 2025, over a third of report respondents – 39% – cited either investments in new or updated equipment or a strategic sales focus as their top priority. In contrast, only 26% cited adding/restructuring personnel or workforce development as a main focus in the coming year, even though these areas are related to the top challenges cited.

In light of the opportunities that do exist for US mold manufacturers, not all facilities responding to this year’s survey are reporting positive business conditions. For example, 53% of respondents report that their company’s overall state of business is good or excellent and almost one-fifth (19%) report business conditions that are bad or poor.

However, of those that report sales up over the last quarter, 81% report changing conditions to new programs and/or volume increases with current customers – a positive indicator for those that have been waiting on the progression of promised purchase orders and on-hold programs.

Conditions for the domestic mold manufacturing community will continue to change dramatically in the coming days and months. In order to stay in tune with the state of business and to dive more deeply into some of the information covered in the 2025 AMBA Business Forecast Report, particularly trends related to quoting, sales, business performance, planned investments, workforce conditions, the state of the plastics industry and more, visit AMBA’s website to access a recording of the 2025 State of the Industry address.

AMBA’s 2025 Business Forecast Report is available for purchase ($399 for members; $899 for non-members) at www.amba.org. This report utilizes data from 33 economic indicator questions to showcase sales trends, profit levels, capital expenditures, shop and design employment levels and challenges, as well as 2024 performance, fourth-quarter performance forecasts and expectations for 2025. Additionally, the 2024 Wage and Salary Report also is available for purchase. To view these reports and others, visit the Publications page at www.amba.org.