By Andrew Carlsgaard, analytics director, First Resource

In an increasingly competitive landscape for hiring and retaining skilled employees, rising healthcare and benefits costs for employers in the United States manufacturing sector have become a significant concern. These employers often face challenges in providing affordable healthcare benefits to their employees while maintaining operational efficiency, competitiveness and profitability. The 2024 Health and Benefits Report, with data from Manufacturers Association for Plastics Processors (MAPP), Association for Rubber Products Manufacturers (ARPM) and American Mold Builders Association (AMBA), aims to provide US-based manufacturers with the most relevant data on the state of healthcare and benefits in the industry and to arm decision makers with the knowledge required to minimize costs while still providing maximum value to their employees.

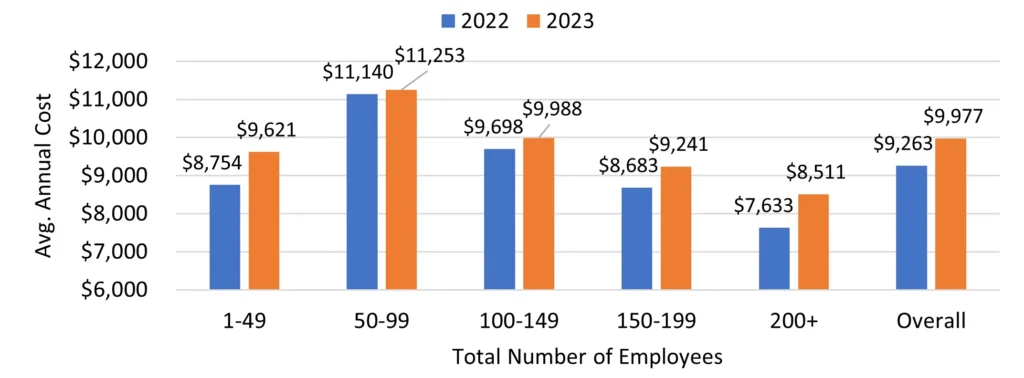

Healthcare plan costs in the US have been on the rise over the past five years due to inflation, prescription drug price hikes and increased expenditures as the baby boom generation nears retirement age. This trend has disproportionately impacted small- to mid-size employers in the manufacturing sector, many of whom have older employee bases in comparison to other industries. These employers, often operating on tight budgets, face the daunting task of providing comprehensive healthcare benefits to their employees while maintaining profitability. According to a 2023 nationwide survey conducted by the Kaiser Family Foundation1, the average annual premium for employer-sponsored health insurance plans in 2023 reached $8,435 (up from $6,896 in 2018) per employee for single coverage and $23,968 for family coverage (up from $19,616 in 2018). The findings in the 2024 Health and Benefits Report, while a different approach in tabulating the totals, show a similar upward trend, with overall healthcare plan costs per participating employee increasing 8% from 2022 to 2023 ($9,263 to $9,977, respectively, Fig. 1). These rising costs place a significant financial burden on smaller employers, making it challenging to offer comprehensive healthcare benefits to their employees without forcing cost-cutting measures in other areas of the business.

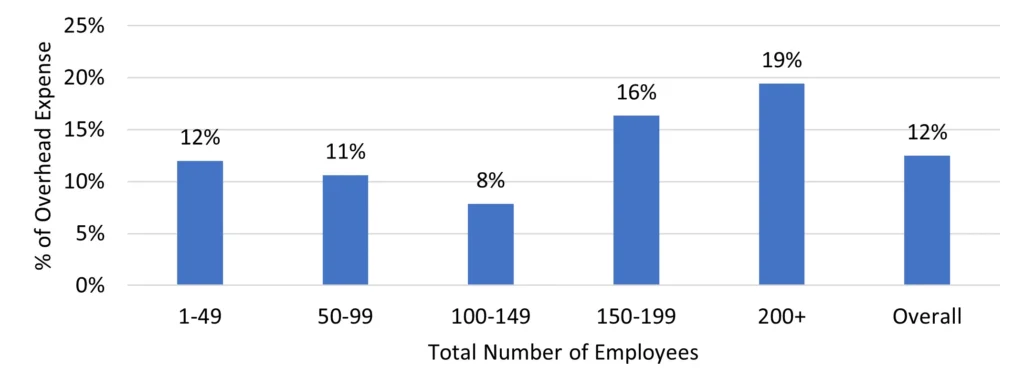

The surge in healthcare costs can strain the financial resources of small- to mid-size manufacturing companies, forcing them to make tough strategic choices. These decisions often involve weighing employee benefits and wages against investments in growth and innovation. Despite the 2024 Health and Benefits Report data indicating that organizations with less than 150 employees allocate a smaller portion of their overhead expenses to healthcare (Fig. 2, page 25), smaller operations generally have less tolerance for increased healthcare costs. A few high-dollar medical expenditures significantly can impact their margins if self-insured or lead to a substantial rate increase in the next year if they are fully insured. A study by the National Association of Manufacturers (NAM)2 underscored that rising healthcare costs were a top concern for US manufacturers, with 58.9% of respondents citing it as a significant challenge affecting their competitiveness. Similarly, in AMBA’s 2024 Business Forecast Report and in both MAPP’s and ARPM’s 2024 State of the Industry Reports, respondents listed rising healthcare costs (along with recruiting and retaining employees) among the top 10 “Challenges Interfering with Profit Margin Goals.”

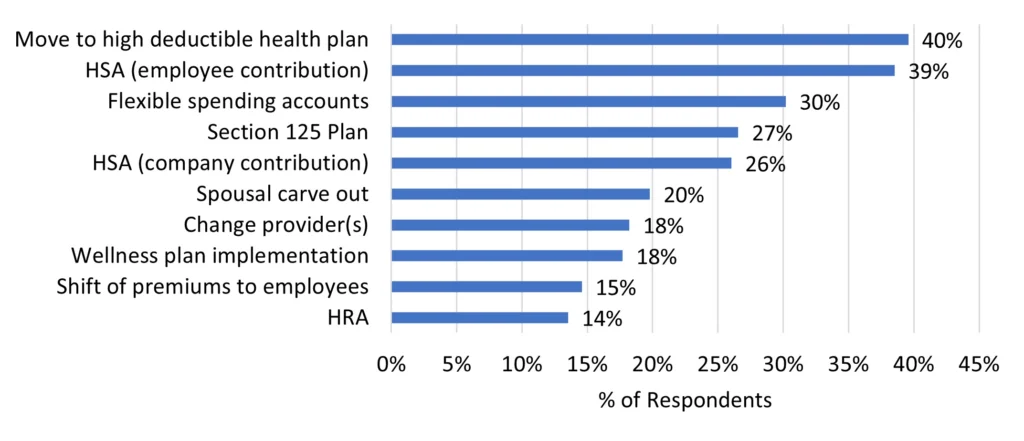

To mitigate the impact of rising healthcare costs, employers in the manufacturing sector have been exploring various strategies (Fig. 3), such as implementing high-deductible health plans (emphasizing employee contributions to HSAs or FSAs), offering wellness programs and changing insurance providers for better rates. This shift is further evidenced by nearly half (46%) of survey respondents providing at least one HDHP in their current plan year, while less than a quarter (21%) offer the once-ubiquitous HMO plan. Additionally, some companies are turning to alternative healthcare delivery models, like telemedicine and on-site clinics, to provide their employees with more affordable and convenient care options, though depending on the size of the operation and the funding methodology, this kind of solution may not be as feasible. Interestingly, survey respondents who had achieved decreased rates in the previous three years listed changing their healthcare plan carrier as the most common method of obtaining a rate decrease, indicating that constantly re-assessing the provider market could lead to savings over time compared to remaining with the same carrier. However, shopping around each year can be a potentially repetitive and time-consuming process for decision-makers (and a potential source of dissatisfaction for employees), as many carriers may initially ‘beat’ the incumbent carrier’s quote to land a new client, with the internal understanding that the new carrier likely will recoup any lost profit in the first year with the following year’s renewal unless the client is willing to switch providers again. Finding other strategic options, such as those listed in figure 3, to realize cost savings while remaining with the same carrier would be preferable to performing this taxing yearly exercise.

In conclusion, healthcare costs are poised to remain a pressing issue for small- to mid-size employers in the US manufacturing sector, potentially hampering their ability to offer competitive benefits and invest in their businesses. It is of the utmost importance for manufacturing executives to actively pursue strategies to manage and reduce these costs. This proactive approach is not only vital for the health and well-being of their workforce but also for mitigating cost and risk. Moreover, it provides a valuable benefit that can enhance the attractiveness of their business to prospective employees. In addition to the 2024 Health and Benefits Report and the annual Wage and Salary Report, AMBA offers resources and strategies that support its members through the annual renewal process by identifying potential threats and how to minimize them. Additionally, AMBA’s captive opportunity provides transparency and financial control, as well as strength from the aggregation of participating members.

Further analysis is available by purchasing the 2024 Health and Benefits Report through www.amba.org (the report is available free of charge to survey participants). The 2024 State of the Industry Report and 2023 Wage and Salary Report (updated rates as of July 2023) are also available at www.amba.org/publications. If interested in becoming a member of AMBA, email info@amba.org.

References

- Kaiser Family Foundation, “2023 Employer Health Benefits Survey”

- National Association of Manufacturers (NAM), “2024 First Quarter Manufacturers’ Outlook Survey”