by Rachael Pfenninger, director of strategic execution, AMBA

As Americans nationwide experience the pinch of inflation, wages continue to be an increasingly hot topic of conversation. Paired with the persistent labor issue (an industry-wide challenge made worse by the coronavirus pandemic), employers are scrambling to see how they can remain competitive in the war for qualified labor.

To help US mold manufacturers better understand the labor landscape and benchmark their wage standards against others in the industry, AMBA again has completed and published its annual Wage and Salary Report. The 2022 AMBA Wage and Salary Report (now in its 12th year of publication) is the nation’s most comprehensive study of wage data, analyzing starting and average salary and wage benchmarks for over 50 job classifications within mold manufacturing. Additionally, the report benchmarks information related to cost-of-living increases (recent and forecasted), vacation benefits, employee incentives, salary adjustment opportunities, hiring expectations, employee demographics and more.

This year’s report is based on data provided by executives, human resource leaders and finance professionals in 107 US mold building facilities across 23 states. Of the four regions represented, the Midwest accounted for the largest percentage of respondents (80%), the bulk of which hail from Michigan, Wisconsin and Illinois.

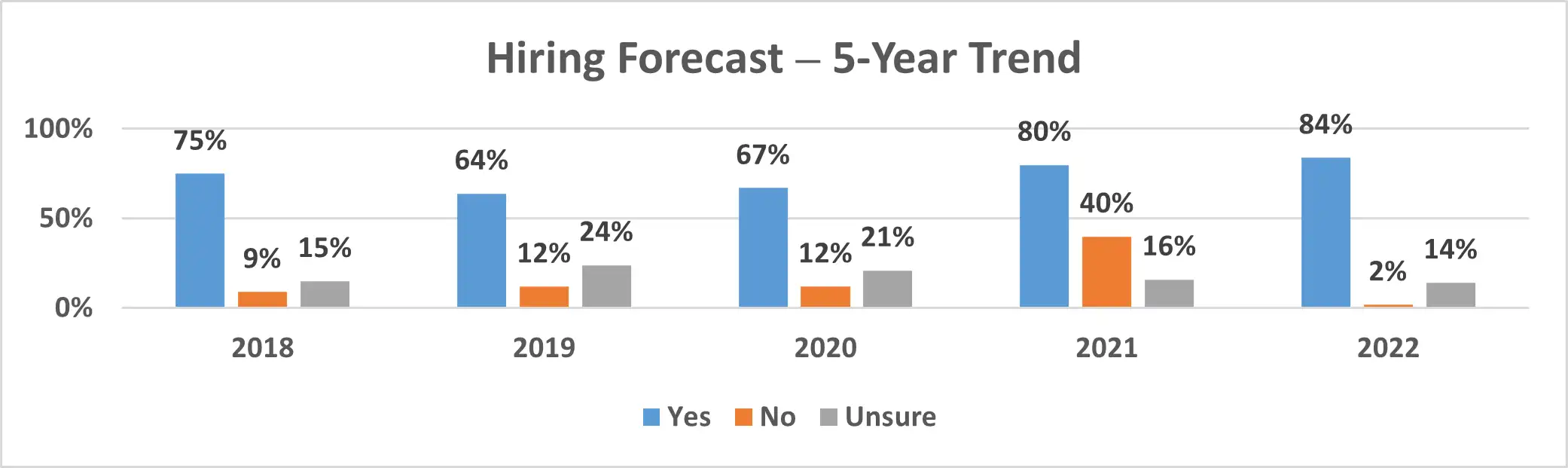

Of these respondents, the majority (84%) intend to hire new employees over the next 12 months (See Chart 1). Although manufacturers reported the need to hire at least one administrative and management position each, technical vacancies were by far the highest priority. On average, companies reported the need to fill a minimum of three vacancies; this rises to five or more for companies producing $10 million or more in revenue.

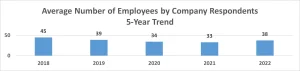

Although the need to fill vacancies is not a new challenge, what is remarkable is that the number of companies seeking new hires has risen by four percentage points and now is at its highest point of the last five years. What makes this even more interesting is that, while hiring labor certainly continues to be a challenge, other data is pointing to some industry improvement. For example, although the number of companies needing to hire has risen, the average number of current employees per facility also has risen for the first time in several years, breaking a three-year decline

(See Chart 2).

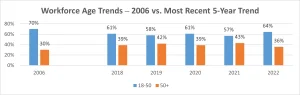

To further the good news, there also is a positive upward trend in employees aged 18 to 50. For the first time since the years before 2018, as shown in Chart 3, this age demographic makes up 64% of the survey’s reported workforce – three percentage points higher than data from 2020 and 2018 (the past two recent peaks) and within six percentage points of levels last seen in 2006.

To see an upward trend in overall employment and a fall in the average age points toward significant improvement within the industry in terms of workforce development. Because it is well-documented that employers are struggling to provide wages that mirror rising economic inflation1, workforce development improvements may be due instead to employers’ willingness to provide additional salary adjustment opportunities, cost-of-living increases and employee incentives. While nearly every mold manufacturer provides merit increases, eight out of 10 mold manufacturers surveyed reported providing salary adjustments across the board and/or cost-of-living adjustments (COLA) in 2022. When asked specifically for details regarding COLA for employees, companies reported an average increase of 3% in 2022 and an average planned increase of 2% in 2023.

Companies didn’t just focus on benefits for existing employees. Nearly three-quarters of respondents provided or currently provide a signing bonus (totaling anywhere from $160 to $3,000), while an even higher percentage of survey respondents enticed new hires with offerings of increased insurance coverage, expanded PTO policies and employee development opportunities.

For many years, fears of an aging workforce have been plaguing the mold manufacturing industry. With this reported data, however, it looks like the tide may be due to turn as employers look to new opportunities to attract labor and keep their existing workforce. n

To learn more about wage fluctuations by position and market segment for the 50+ roles featured in the 2022 AMBA Wage and Salary Report, visit www.amba.org. The report is available for $299 to members and $499 to non-members.

References

1. https://www.weforum.org/agenda/2022/06/wages-why-are-they-not-keeping-up-with-inflation