by Dianna Brodine, managing editor

The American Mold Builder

In 2017, the North American annual mold and die spend is estimated to be $15.1 billion. Of that, $11.1 billion will be sourced for the automotive industry, $0.7 billion will be related to the appliance industry and $3.3 billion will be allocated to all other industries combined.

It’s no wonder that a predicted dip in automotive tooling spend is causing concern among US moldmakers.

Harbour Results, Inc., Southfield, Michigan, recently released the results of its annual in-depth study on the current state of the automotive vendor tooling industry. While mold build activity is anticipated to be strong for the next two to three years, the report indicates a return to 2016 levels by 2020.

Where is the industry now?

North American light vehicle sales have dipped slightly since 2016, but the number of new launches has seen an increase. This is good news for toolmakers. “Mold shops seemed to be busy for much of the year,” said Laurie Harbour, president of Harbour Results, “and 2017 has been one of the strongest markets in several years across all industries.”

The challenge is that the dependent nature of the tooling industry has meant a struggle for mold builders to maintain a constant level of quote activity, sales volume and profitability. “The tooling providers struggle to string together four consistent quarters of volume,” Harbour explained. “The build market softens when customers aren’t active, but then they get a lot of quotes and it booms again.”

As a result, some companies are still struggling, despite the stronger market. “Some of it is because the tool builders don’t have a good sales process, so they’re not keeping the funnel full,” said Harbour. “But, primarily the struggle is industry related, in that the industries are cyclical, with volume that comes and goes at different times. For instance, automotive tends to launch in the third and fourth quarter.”

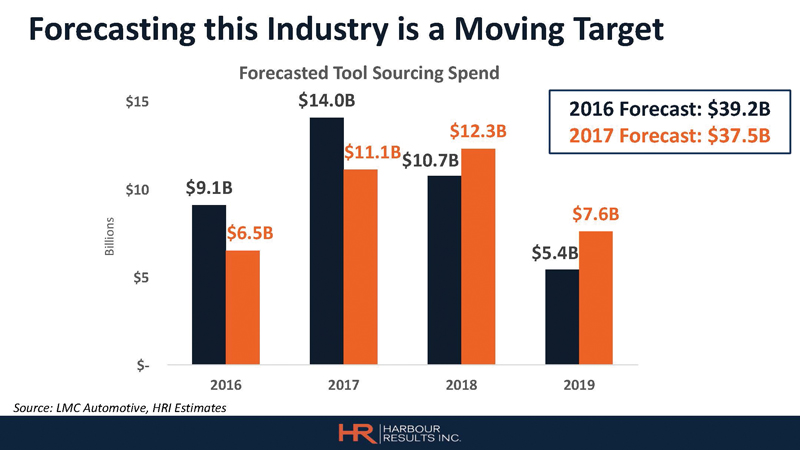

The 2017 automotive tool sourcing spend was forecasted at approximately $11.1 billion, according to Harbour Results and LMC Automotive, and 2018 should see an increase to $12.3 billion – indicating continued work for mold builders. “This has resulted in high capacity utilization among tool shops – 88 percent for die shops and 81 percent for mold shops,” said Harbour. “This created a new tooling model of outsourcing. In fact, $1 to $1.5 billion of tooling was outsourced this year to help manage the growing demand. We can only expect this trend to grow in 2018.”

What’s happening in the automotive segment?

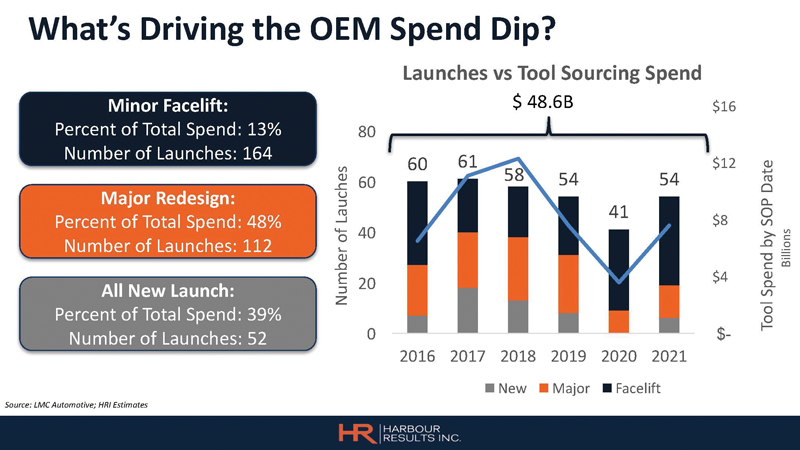

The key factor driving increased tooling spend over the last couple of years is the high number of North American vehicle launches predicted between 2018 and 2020 – 177 vehicles. Additionally, 66 percent of these launches are sport utility vehicles (SUVs) and truck platforms, which require more tooling to manufacture than a car platform.

“We’re seeing huge growth in model types, but the average volume per model is down,” said Harbour. “It’s a high-mix, low-volume market, which is good for toolmakers, but hard on the automotive OEMs. It also adds cost pressure, which will drive down through the supply chain.”

While the high number of new vehicle launches will provide work for automotive toolmakers, that doesn’t necessarily mean a significant amount of new business – and, it doesn’t create a consistent volume of new work either. The report also uncovered a tooling spend threshold for any given year of $9 to $10 billion. According to Harbour, the North American auto industry struggles to achieve spend beyond this threshold, due to a number of factors primarily found across the OEMs and Tier 1s.

“The major point that needs to be made is that this is not a toolmaker problem – it’s an entire value stream issue,” said Harbour. “When there are delays in program launches from the OEM, it creates capacity issues for the tool builder – overcapacity one quarter and not enough in the next. And, this isn’t just an automotive problem. It happens across all industries.”

Will there be a dip?

To those asking if a dip is ahead for the automotive tooling market, the short answer is “yes.” The more complicated answer: It’s difficult to predict when it will happen.

Chart 1 illustrates the change in timing caused by program delays – annual spend can shift from one year to the next based on delays at the OEM or Tier 1, which then pushes to the toolmaker. In 2016, the tool sourcing spend for 2017 was estimated at $14 billion. However, the actual number is now predicted to be lower, as delays push launches into 2018 and 2019.

What is clear, however, is that automotive OEMs were designing new vehicles from 2010 to 2014, and now it’s time to launch. In addition, there are new foreign-owned plants and products planned through 2020, so the industry will see launch increases in the short term.

However, there are several indications that these launches will drop off as early as 2019 or 2020. First, several vehicle models are forecasted to drop from the market as GM is planning to discontinue some Buick models and Chrysler is ending car production. In addition, Ford Focus and Taurus production has moved to China, and many automotive manufacturers prefer to source tooling at the build site.

Also of concern is a trend in the mix of launches. OEMs are expected to implement vehicle “facelifts” once they evaluate the successes of launches occurring in 2017-2020, changing a handful of components rather than redesigning the vehicle from the inside out (Chart 2).

“The effect on toolmakers,” said Harbour, “is that they may see a drop in all new and major launches, resulting in a slowdown of new tooling.”

Also affecting automotive industry trends is the push toward battery-powered and electric vehicles. “Clearly, a model shift is coming,” Harbour explained. “The launches planned from 2017 are 2022 are still focused on the internal combustion engine, and OEMs will expect this product to satisfy the market for the next six to 10 years. From 2027 to 2030, the launches will focus on electric vehicles. Toolmakers need to start looking at innovations, because OEMs will be asking for different things from their tooling suppliers.”

The report projects a drop of 40 percent in tooling spend from the high of $11 billion in 2018 to approximately $6.7 billion in 2020. However, toolmakers specializing in automotive should note that the 2016 spend was $6.5 billion, so the drop represents a return to prior levels rather than a catastrophic loss of business.

in 2021.

What does it mean for tool builders?

“We conduct the annual study to help the automotive tooling industry develop better near- and long-term business strategies and to prepare for the future,” said Harbour. “Although the predicted dip in 2020 is not nearly as significant as we experienced in the recession, it is important that tool shops continue to focus on improving operations and investing in technology during the good times to remain competitive during the dip.”

Harbour recommended a focus on the sales process, suggesting that automotive tool makers position themselves for 2020 by evaluating their current programs and customers. By understanding profitability and estimating future volumes, tool builders can determine targets for the future. “Diversifying in tooling isn’t that easy,” she said, “so people need to understand their position in the market and their specific niche, whether that’s a product niche or a relationship niche. Then, they can position themselves with those customers for the future.”

Harbour emphasized, “There is still significant work in automotive tooling, even beyond 2020. We’re predicting $6.5 billion in spend, so there will be work – but only if the tool builders are positioned the right way to capture it.”