By Rachael Pfenninger, director of strategic execution, AMBA

In spring 2024, AMBA published its 2024 Health and Benefits Report, where executives and management teams expressed significant concern over rising healthcare and benefits costs. Now, as indicated from the data in the recent AMBA 2024 Shop Rate Report, it looks like this business area was just one cost of many that has considerably risen over the last year.

In short, as one respondent wrote in explaining why the overhead percentage has risen, “The cost of everything is going up… Every. Single. Thing.”

As costs rise across the board, it has become more important than ever for US mold manufacturers to benchmark every financial decision, particularly when it comes to the rates being charged for offered services. To help the AMBA community make knowledgeable, business-driven decisions, AMBA published its 2024 Shop Rate Report with the same trending data as years past, complemented with an increase in expert industry insights and open-response answers.

This year, over 70 US mold manufacturers participated in the survey process for this report, which benchmarks charge rates for services supplied by US mold manufacturers in engineering, moldmaking and specialty services. The majority are located in the Midwest region, specializing in plastic injection molds and produce between one million and 10 million in annual sales revenue.

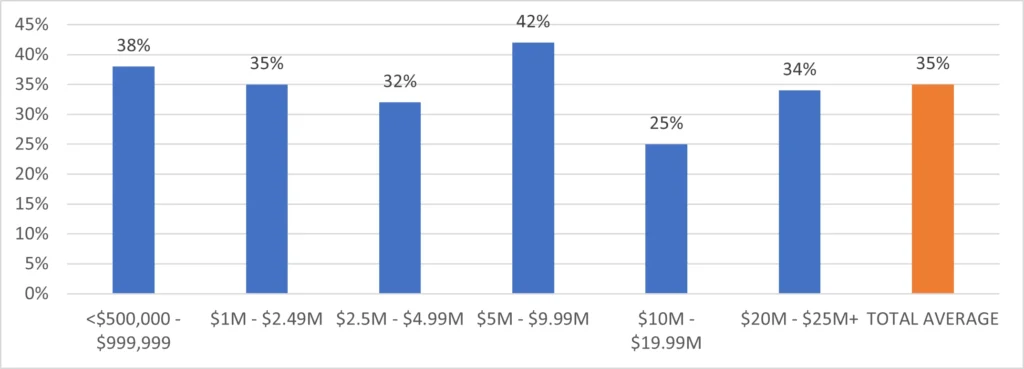

Overall, when examining charge rates across all industries and annual sales revenue ranges, moldmakers have indicated a rise in shop rates in 2024, more dramatic than in recent years past. These rate increases could be due to numerous factors. In addition to a late response to last year’s economic conditions – specifically, high inflation rates and rising consumer prices – many executives also point to rising overhead (which rose to 35% this year, see Chart 1 below), labor costs and economic uncertainty due to the coming 2024 US presidential election.

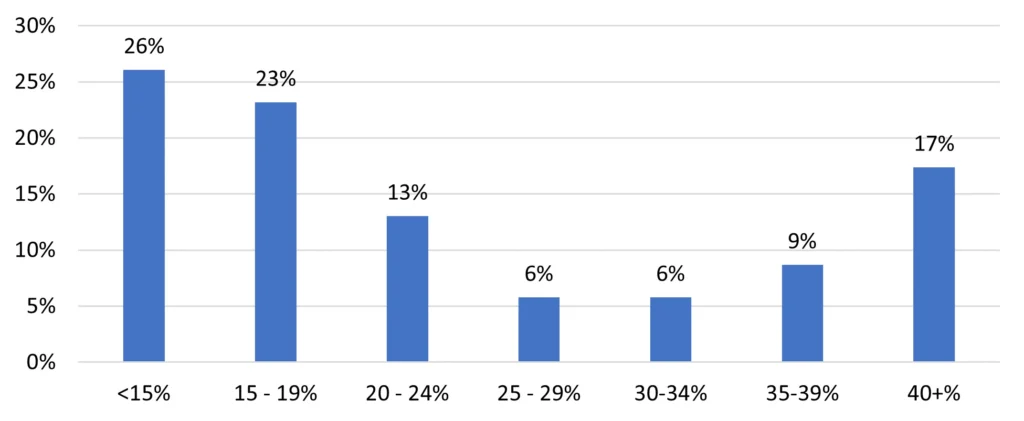

Not all is doom and gloom, however. When specific rates were examined, the 2024 Shop Rate Report highlighted several charge rates that actually fell year-over-year (particularly for unattended services) for the first time in this survey’s history. Additionally, for those concentrating more heavily on specific sectors (conducting 40% plus of their business specifically in automotive, medical/dental/optical or consumer products), 2024 gross margins rose considerably over 2023 percentages (Chart 2 on page 36).

In addition to the charge rate data provided, key components of this report include the business tips on potential efficiencies and the economic and industry-wide insights supplied by AMBA partners, Wipfli and R.E.R. Software. Within these insights, recipients of the 2024 Shop Rate Report are able to glean more perspective on current industry trends, how those trends may impact rates in the coming months and the ways in which domestic mold builders can implement efficiencies to offset uncertain economic conditions and prepare for technological advances.

While increasing charge rates, rising costs and economic certainty paint a challenging landscape for the domestic mold building industry, respondents did report some optimism. Although current capacity utilization is hovering around 71%, respondents reported an anticipated rise of 3% in the coming months, likely in hopes that customer projects currently on hold will be released soon.

To learn more and purchase AMBA’s 2024 Shop Rate Report, visit www.amba.org/publications/browse. This annual report is available for $399 only to current AMBA members in good standing with the association. * Those who purchase the report or participated in its data collection also will have access to a recording of the 2024 Shop Rate Data and Economic Trends Webinar.

*Non-members interested in joining the AMBA so that they may access the report can contact the AMBA offices at 317.436.3102 or info@amba.org.