By Rachael Pfenninger, director of strategic execution, AMBA

In recent months, the need for employees – in all areas of the US manufacturing operations – has risen to a fever pitch. According to the Indeed Job Posting Index, employer demand in the manufacturing sector was 51.3% above pre-pandemic levels as of September 2023. When taking into account the pre-existing skills gap of 2.1 million job openings that existed before 2020, it’s clear that prospective employees continue to have the upper hand in today’s labor market.

As a result, many domestic manufacturers find themselves somewhere between a rock and a hard place. As business continues to perform above expectations for many prime industries, such as medical, dental and optical markets, aerospace, defense and others, manufacturers must decide – do they give up on or delay business or do whatever it takes to fill open positions?

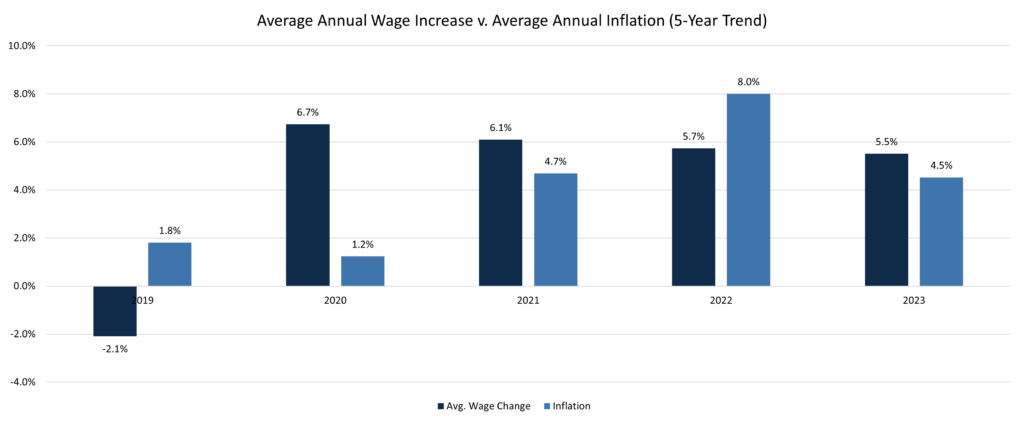

Many US manufacturers, unsurprisingly, have opted for the latter over the last few years. Not only does this mean that average wages have continued to rise year-over-year (despite the simultaneously increasing pressure of inflation, which, as seen in chart 1, peaked dramatically in 2022); in past surveys conducted by the American Mold Builders Association (AMBA), employers also have indicated their willingness to increase signing bonus opportunities, referral bonuses, merit increases and other financial incentives to sweeten the pot.

However, despite the continuing rise in wages and the distribution of other financial incentives, it seems that many US mold manufacturers are realizing this effort isn’t sustainable. According to AMBA member interviews and AMBA’s most recent wage data from its 2023 Wage and Salary Survey, for example, US mold manufacturers indicated the utilization of a variety of other employee incentive strategies that leverage a combination of the aforementioned financial incentives alongside a number of opportunities and benefits.

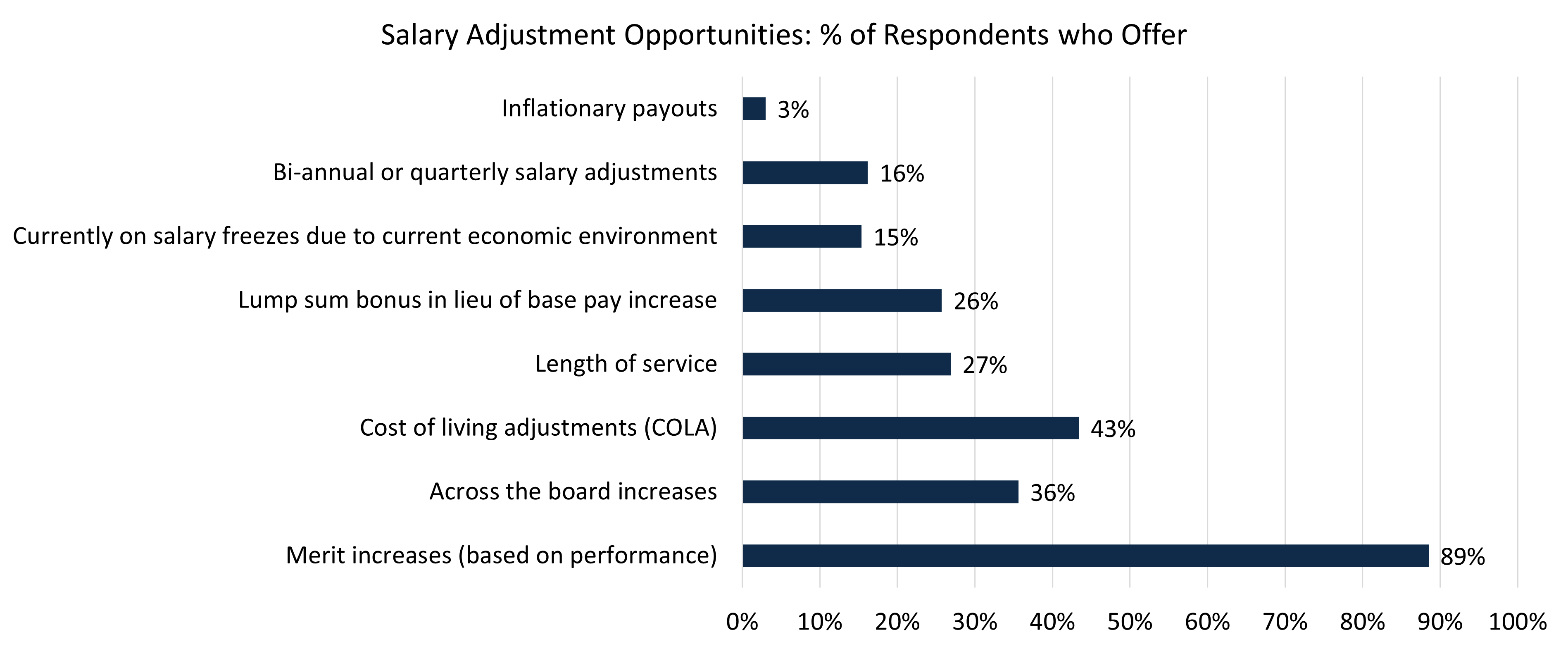

For example, while nearly one-fifth of respondents reported offering signed bonuses to new employees, a much higher percentage (nearly half) provide referral bonuses. This means that it’s the current employee that benefits more often than the new hire.

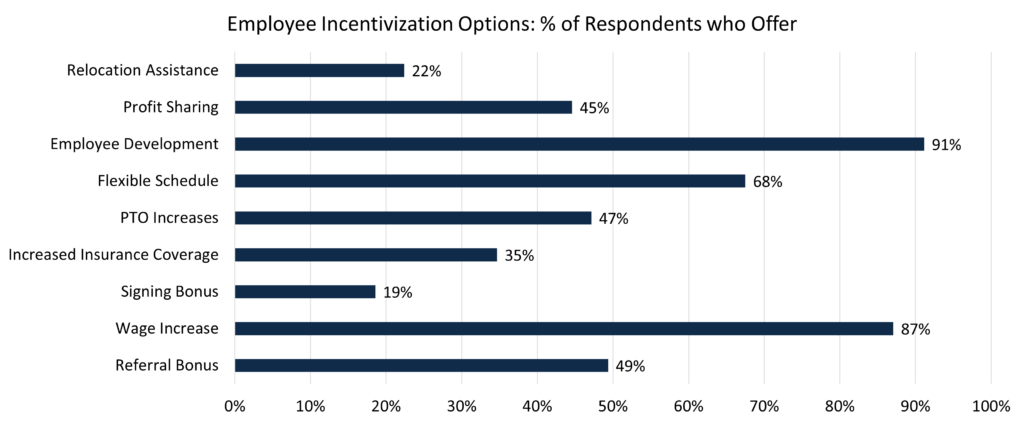

Another example of the balance between financial incentives versus other employee benefits is that, while the majority of employers (87%) have offered wage increases due to cost-of-living-adjustments, across-the-board salary increases and company profitability (Chart 2, page 33), over a third of 2023 survey respondents also have chosen to offer increased insurance coverage, while two-thirds are offering flexible schedules, which help address other employee pain points and needs (Chart 3, page 33).

Of all of the employee benefits cited in this year’s survey data, one of the most notable was that over 90% of this year’s responding companies reported offering employee development opportunities. Two members – Nicolet Plastics, LLC (Mountain, Wisconsin and Jackson, Wisconsin) and Prestige Mold, Inc. (Rancho Cucamonga, California) provided their perspective on why these alternatives – particularly employee development – are so important to company health and its ability to employ a stable workforce.

“When our company experienced an increase in turnover during COVID, our team recognized a need to go ‘back to the basics’ and determine how we could better support our team members,” explained Lisa Pichotta, director of human resources at Nicolet Plastics.

The company’s leadership team knew that something needed to be done, so it decided to sit down and tackle the problem head-on. “A cross-functional team was developed to drive this initiative forward. Those efforts led to the initiation of our Leadership Training Program (now in its third year) and the company’s ‘War for Talent’ project, out of which came incredibly impactful attraction and retention strategies,” Pichotta stated. “Today, our turnover percentage is significantly lower and we’re much more intentional about each team member’s development path, the investments we make as a company and the culture we cultivate.” Pichotta concluded that the new focus has been tremendously successful for Nicolet, which is reflected in the impact it’s had on the company’s workforce.

Todd Steging, the general manager at Prestige Mold, Inc., agrees with the impact that development and leadership opportunities can have on an employee’s loyalty and commitment to the company. “I know that others are struggling with factors like inflation and competition, but we’ve been really fortunate in that we made investments in our people and company early on,” Steging said.

“From the jump, we pay our employees competitively – but more than that, we give them opportunities to grow and we celebrate their accomplishments. From employee satisfaction surveys and leadership development to investment in new technology and company transparency, we try to focus on and understand all of the features that can positively impact an employee’s experience.” The payoff, according to Steging, has been low employee turnover and high employee engagement.

Although the percentage of US mold manufacturers still seeking employees for one or more positions has dropped slightly from 84% in 2022 to 78% this year, the battle for employees is likely to continue. So, whether it’s through professional development, exposure to new learning opportunities or some other employee incentivization strategy, manufacturers would be well-served to explore any opportunity that will help attract and retain employees – because it doesn’t look like the labor market is easing any time soon. n

Every year, AMBA publishes its annual Wage and Salary Report, which highlights average, low and high wage rates across over 50 common positions in US mold manufacturing. This year, the report also will highlight cost-of-living-adjustments (COLA), employee incentivization strategies, pay differentials, financial incentives, bonus structures and more.

To learn more and purchase a copy of the final report, visit www.amba.org.