By Rachael Pfenninger, director of strategic execution, AMBA

Cautious optimism reigned in this year’s American Mold Builders Association (AMBA) 2023 Business Forecast Report, where just over 90% of respondents indicated that business conditions were fair or better. However, other economic factors – such as inflation and continuing pressure from foreign competition – continue to challenge the industry, leading to an increased focus on process efficiencies, capital investment and reallocation of personnel.

SURVEY HISTORY

Now in its 13th year, AMBA’s annual Business Forecast Report analyzes data collected from mold manufacturers all over the United States. This year’s report represented 83 US mold manufacturers across 17 states, over three-quarters of which were concentrated in the Midwest region. With the aggregated data supplied in this report, industry executives are able to better benchmark how their companies stack up to industry norms and better align their anticipated outlook for the year.

PROFITS AND HISTORICAL DATA

As the industry heads into 2023, the current state of business remains relatively stable. When considering year-over-year conditions (up, down or the same), approximately 40% or more of survey respondents indicated that employment and backlog were the same, followed by another 35% or more who indicated that they were up. In the case of shipments and backlog, these percentages were swapped; over 40% indicated that both were up, followed by over 30% who said they were the same.

When comparing Q4 2022 conditions with Q3, both shipments and employment improved, while quoting and backlog each fell. None varied more than 5%, with the dramatic exception of those who reported that backlog was up; last year, 39% of respondents indicated that backlog was up heading into Q4, while this year, that percentage fell to 25% (a fall of 14 percentage points).

CURRENT AND EXPECTED CAPACITY UTILIZATION

In addition to surveying respondents on the current state of their pipeline, AMBA surveyed companies on their current and anticipated capacity utilization. Overall, the industry showed considerable improvement in both its current and anticipated capacity utilization percentages. Current capacity utilization rose to 74% (a 3% increase over last year’s data), while anticipated capacity utilization rose to 78% (a 9% increase over 2022 data).

To better understand capacity and sales activity within the mold building industry, respondents again supplied data regarding jobs received as a percent of jobs quoted. Thirty-eight percent of respondents received between 26% or more (up to 75% plus) of all work quoted, while 32% of respondents received 10% or less; of that 32, a shocking seven received 2% or less of all jobs quoted. This data represented an average win rate of 31% for all jobs won.

CHALLENGES AND SHIFTING PRIORITIES FOR MOLD MANUFACTURERS

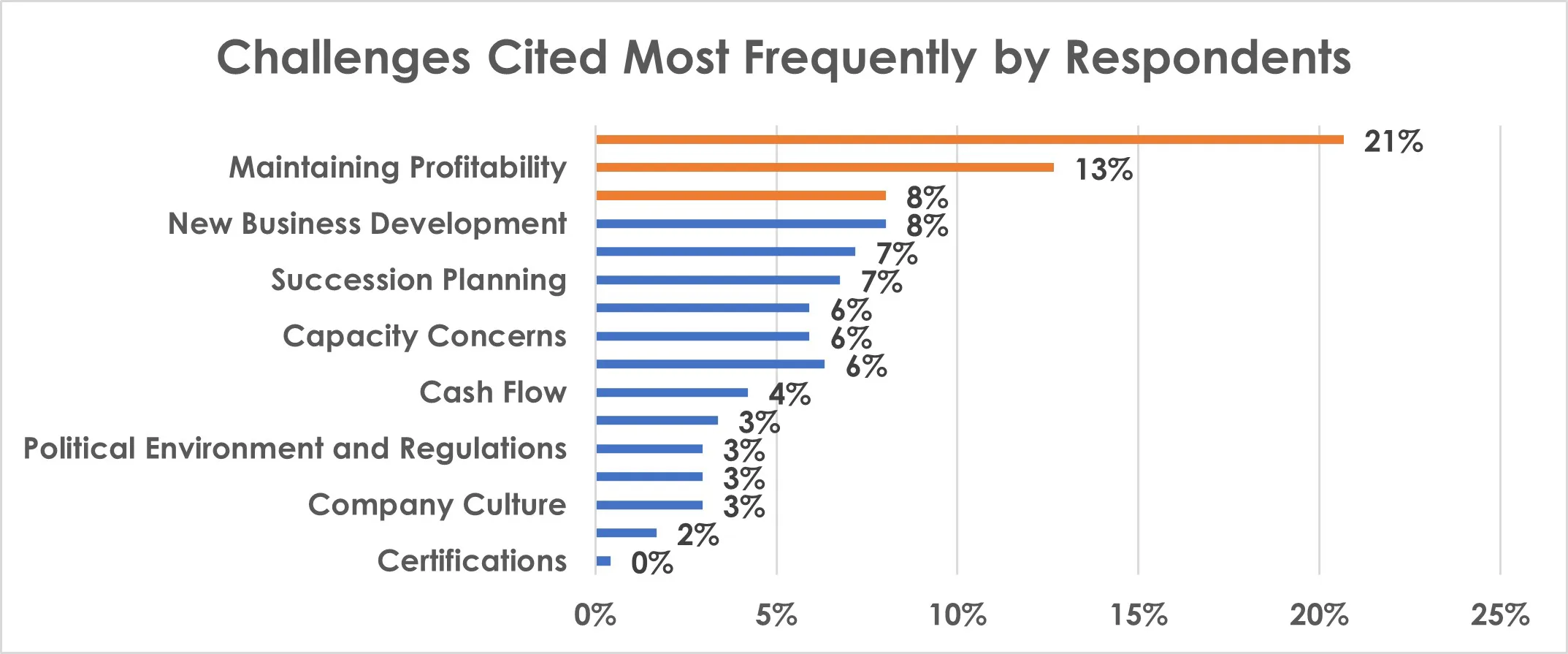

Although workforce development continues to be the number one challenge for US mold builders, it continued to shrink this year in response to the growing threat of other varied challenges. For example, while familiar industry challenges such as maintaining profitability, cost pressure, new business development and operational efficiency remained on the list of concerns (Chart 1), a new red flag was raised when rising inflation was cited as the top contributor to weaker profits (cited eleswhere in this year’s report).

In an effort to mitigate increasing costs and improve competitiveness, mold manufacturers plan to further invest in process efficiencies, new equipment and personnel development that will enhance operational efficiency, automation and personnel development – all prevailing areas of focus moving forward according to a majority of survey respondents (Chart 2). Additionally, over one-third of respondents agreed that additive manufacturing will enhance business operations and nearly two-thirds indicated that sector-specific revenue will increase in 2023, with the sporting goods category at the top of the list.

MOLD MANUFACTURERS SEE KEY GROWTH IN EMPLOYMENT DEMOGRAPHICS

One bright light that shone at the end of the tunnel in this year’s report was the positive impact seen in employment. Although 92% of mold manufacturers reported having at least one open position to fill (and nearly 40% reported three or more open positions), the percentage of respondents who reported that employment was up vs. three months ago rose to its highest level since 2018; before that, the previous peak was 2013. This pairs with positive news reported from the 2022 AMBA Wage and Salary Report as well, where the group of employees aged 50 and under rose to its highest level since 2015.

For the first time, a new, interactive format for this report has been created and now is available to AMBA respondents at no cost, as well as to AMBA members at $299 and non-members at $499. The new layout utilizes existing data, video insights and “how-to” tips to help viewers draw conclusions and better utilize the data in day-to-day business.

To learn more about the 2023 Business Forecast Report, the state of the mold building industry and to access additional benchmarking information, visit www.amba.org.