by Rachael Pfenninger, director of strategic execution, AMBA

At the end of 2021, the American Mold Builders Association (AMBA) surveyed US mold manufacturers on compensation data across 51 unique job positions. At that time, the AMBA benchmarking team discovered that, despite experiencing the highest inflation rate since 1982 (7%), mold manufacturers were continuing to raise wages as they battled a worsening labor shortage. In 2022, mold manufacturers experienced little relief; as of August 2022, the United States faces an inflation rate of 8.5%, after surviving a spike to 9% the previous month.

With this perspective, it is more imperative than ever for domestic mold manufacturers to understand how they can most efficiently compete in the marketplace. For this reason, the AMBA once again surveyed US mold builders on charge rates across over 20 moldmaking, engineering and specialty services. To provide more in-depth data, the AMBA team relied heavily on insights from mold manufacturing executives and was able to provide a

deeper analysis of overhead, gross margin, mold build details and both attended and unattended rates (as applicable).

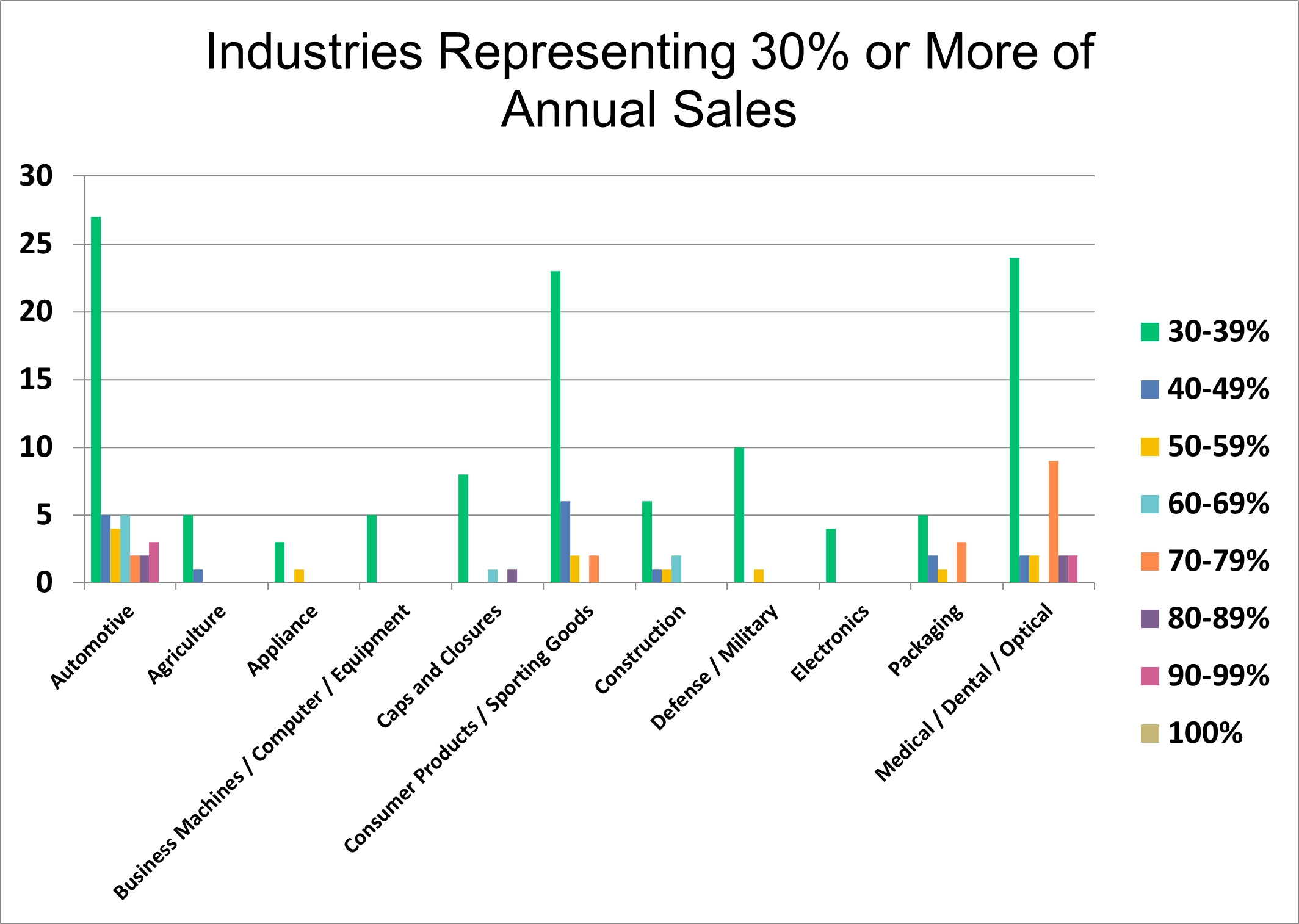

The final report includes survey responses from 70 US mold manufacturers from 21 states, primarily located in the Midwest region. The industries served most frequently by this year’s respondents include the automotive, consumer products and medical/optical/dental industries. For the first time, respondents indicated not just which markets they primarily served, but what percentage of work that industry accounted for over the last 12 months. Of the respondents represented in this data set, only seven indicated that a single industry represented 80% or more of their total revenue; no company indicated that a single industry accounted for 100% of its total revenue (See chart 1).

Overwhelmingly, respondents – 86% – identified new mold/die builds as their primary revenue generator. To expound on revenue sources, this year’s survey also asked respondents to identify their second-largest revenue source (only identifiable if it generated 20% or more of total annual revenue over the last 12 months). Of the provided options, mold/die repairs and engineering changes were identified by 61% of respondents as the second-largest revenue source (another 13% also identified this option as their primary source of revenue).

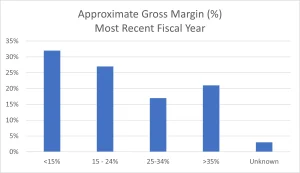

Respondents also were asked to provide their approximate gross margin percentage, calculated as ((Revenue – Cost of Goods Sold) / Revenue) * 100. Nearly one-third of respondents indicated that their average gross margin was relatively thin (under 15%) while another 27% of respondents identified their approximate gross margin percentage as regularly between 15-24% (See chart 2).

On average, mold manufacturers reported a current utilization of 72%; anticipated capacity is expected to rise an average of 1% through the end of the year to 73%. Respondents also provided insight into the approximate percentage of their shop’s overhead costs compared to total annual expenses.

Of the service charge rates studied, no service had only one mode (a single rate that was cited most frequently). For this reason, notable modes – or “peaks” – were identified for every charge rate. To better illustrate this year’s data, all charts were reformatted as scatterplot graphs to better illustrate the frequency and distribution of charge rates for each service area. Additionally, respondents were able to add both attended and unattended rates for the following services: 5-axis machining, 3D printing steel core and cavities for conformal cooling, CNC milling, EDM drilling, gun drill operation, high-speed milling (30k+ RPM), sinker EDM, surface grinding and wire EDM.

The full 2022 report illustrates additional information on over 20 individual charge rates, as well as further charge rate breakdown by annual sales revenue and/or by the top three primary industries served.

To protect the interests of its members and the competitive advantage of the US mold manufacturing industry, the final report is available at no cost only to AMBA members who participated in this survey process. AMBA members who did not participate are able to purchase the report for $349. This report will be unavailable to any non-member (regardless of participation). Eligible parties interested in purchasing the report can visit the AMBA publications page at www.AMBA.org. n