By Rachael Pfenninger, Project Manager

AMBA

Although nearly 90% of mold builders report that current business conditions are positive in the American Mold Builders Association (AMBA) 2020 Business Forecast Report, several business indicators shifted significantly when compared to last year’s data. Amid rising challenges related to increased foreign competition and maintaining profitability, it seems likely that the industry may experience slowing or stagnating growth as it heads into 2020.

Survey history

Now in its 10th year, AMBA’s annual 2020 Business Forecast Report analyzes data that was collected from more than 110 senior-level executives representing US mold manufacturing shops across 24 states. With this information, mold building companies are able to better benchmark how their companies stack up to industry norms, and executives can better align their anticipated outlook for the upcoming year.

Profits and historical data

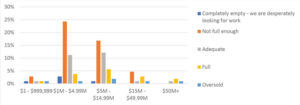

As the industry heads into 2020, current profitability and employment maintain historical trends, but other economic indicators forecast uncertainty and slowing growth within the industry. Fourth-quarter trends hit near historic lows, as 76% of respondents reported that fourth-quarter quoting was either the same or down (up 13% from the previous year) while 75% of respondents (compared to 60% last year) indicated that backlog was the same or down. This data reflects new information benchmarked this year on the state of mold builders’ pipeline in the first quarter. Over half of mold builders reported that either their pipeline is not full enough or they are desperately looking for work; just over one-fifth of respondents said their pipeline is full or oversold.

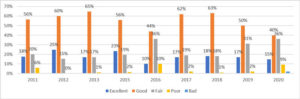

From a historical perspective, trending data on current business conditions reflects the information above. Overall, only 40% of respondents (10% fewer than last year) reported good conditions, while only 15% reported that conditions are excellent. For the first time since 2011, a percentage of respondents indicated that conditions are bad (i.e., that their pipeline is empty).

Current capacity utilization

In addition to surveying respondents on the current state of their pipeline, AMBA also surveyed companies on their current and anticipated capacity utilization.

Overall, the industry reported an average capacity utilization of 67%. Companies under $4.99 million in annual sales revenue tended to fall under the average, reporting lower capacity utilization (57% to 58%), while companies with $5 million or more in annual sales revenue tended to be above the average (68% to 83%). All respondents believed that their capacity utilization would rise in 2020, resulting in an overall industry expectation of an average of 72%, five percentage points higher than the current state.

Mold building industry challenges

Despite its continued standing as a primary challenge facing the mold building industry, workforce development fell for the first time in three years – declining from a challenge reported by 100% of respondents in the previous year to 93% in this year’s survey. While it remains a critical issue within the industry, this change reflects a shifting of priorities. Challenges related to new business development, for example, were reported by 46% of respondents this year – a 13% growth over last year’s data. Maintaining profitability also shifted significantly, rising from a challenge faced by 7% of respondents in 2019 to 20%. Finally, foreign competition continues to weigh heavily on the US mold building industry and has risen in importance in this year’s report. (Read more on this topic on pgs. 22 and 23).

Efforts to increase competitiveness

As mold builders reviewed what challenges they faced in 2020, they also shared what was planned in 2020 to improve their overall competitiveness within the industry. Twenty-six percent of respondents reported that they intend to purchase new or update current equipment, while 15% of respondents have plans to concentrate on workforce development (an 8% increase over last year’s data). Another 14% plan to hone their strategic sales focus (an increase of 9% over last year’s data). Continuous improvement initiatives – which were planned by 25% of respondents last year – dropped to only 12% this year.

Overall, plans to improve competitiveness were in line with the challenges shared and demonstrated a renewed commitment to tackling the workforce development problem and the need to become more profitable.

Despite lower-than-average economic indicators heading into 2020, mold builders can feel some optimism. With recent changes to the tariff exclusions placed on Chinese-built plastic injection molds by the United States Trade Representative (USTR), many mold builders are hopeful that domestic work will begin to return to the US and that the pressure of foreign competition will ease.