By Rachael Pfenninger, project manager

AMBA

For mold manufacturers, managing the sales pipeline – including sourcing potential work, managing incoming leads and following up on unquoted work – can be a daily challenge, especially when mold builders often are at the mercy of everything from government policy and strength of the economy to changes in material cost and the time of year.

To understand this challenge better and to get a picture of how industry members best manage their sales pipelines, AMBA conducted its first sales survey. Respondents provided information on how they manage incoming leads and quoted work, both with and without the use of automated ERP (enterprise resource planning) and/or CRM (customer relationship management) systems.

This survey represented 41 mold builders, the majority of which reported annual sales between $5 million and $14.9 million and whose top three industries served included the automotive, consumer goods and medical industries. Over three-quarters of respondents were located in the Midwest region of the United States, with one-quarter of participants located in Michigan alone.

On average, total employee count correlated directly with annual sales; for example, as annual sales doubled, so did overall employee count. However, the number of sales employees – internal or external – did not rise at the same rate. Even as annual sales rose by five or 10 times, mold builders continued to employ fewer than five employees dedicated exclusively to sales.

Interestingly, even though the count of dedicated sales employees did not rise proportionately alongside reported annual sales, there was a shift in which companies sourced more than 50% of the company’s sales leads.

While more than 40% of respondents with annual sales between $1 million and $4.9 million report having owners or presidents source sales leads, that percentage drops to 10% for companies reporting up to $14.9 million in annual sales and 0% for companies reporting over $15 million in annual sales.

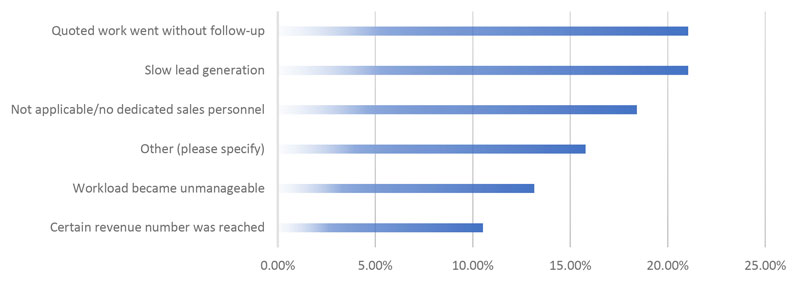

Respondents also shared their primary motivator for hiring dedicated sales personnel. When surveyed, more than 20% of respondents indicated that the two most popular motivators for hiring dedicated sales personnel included slow lead generation at the time and/or that quoted work went without follow-up. Both responses indicate that respondents were primarily motivated when it became clear that their company’s bottom line was being affected (See Graph 1).

Other reasons for hiring dedicated sales personnel included the following:

- The workload becoming unmanageable

- Reaching a certain revenue number

- Needing to improve current sales growth or regional coverage via dedicated account management

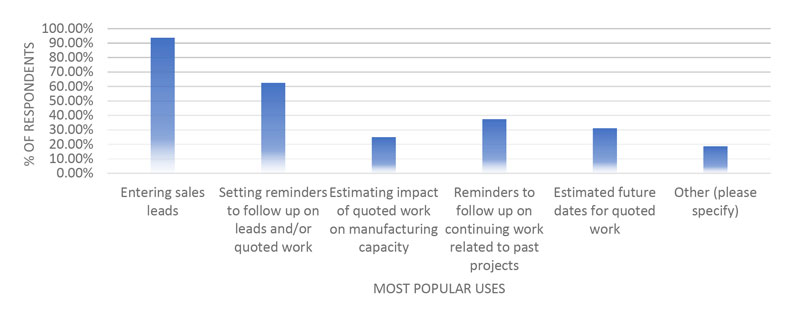

Of course, personnel on staff are not the only portion of an effective sales management strategy – technology also can play a role in the efficiency of lead intake and tracking. Overall, mold builders utilizing ERP and/or CRM systems to track sales leads and/or quoted work tended to be satisfied with their implemented systems. The most popular uses of such systems included tracking sales leads and customer information; providing quoted work to customers; setting follow-up reminders on either future, current or past work; and estimating the impact of quoted work on manufacturing capacity. While many mold builders cited time to implement and time to train as CRM and/or ERP challenges, all of the mold builders named some benefit to having implemented an ERP or CRM system in their sales management process (See Graph 2).

In addition to personal sales management strategy, mold builders surveyed in this study also were asked two questions regarding cyclical trends that impact incoming leads and/or quoted work. When asked whether such trends existed, more than 50% of respondents answered in the affirmative. These responses included factors such as the strength of the economy, industry-specific updates (i.e., new safety regulations for plastics processors), time of year and government policy.

To purchase a copy of the final report and see other available benchmarking reports, visit AMBA.org/resources/publications.