By Ashley Burleson, analytics manager

AMBA

As of now, 81 percent of moldmakers report that current business conditions are positive. However, these conditions will likely plateau or even decrease throughout 2018, as only five percent of mold manufacturing executives anticipate substantial increases in business over the next 12 months, according to the 2018 Business Forecast Report recently published by the American Mold Builders Association (AMBA). Several key indicators supported the anticipated plateauing business conditions, including fourth-quarter performance, industry challenges and trends in offshoring molds.

Now in its eighth year, AMBA’s annual Business Forecast Report analyzes data collected from more than 100 senior-level executives representing US mold manufacturing shops across the country. This report helps company leaders benchmark how their companies are stacking up in comparison to the moldmaking industry norms and helps executives to better align their anticipated outlook for the year.

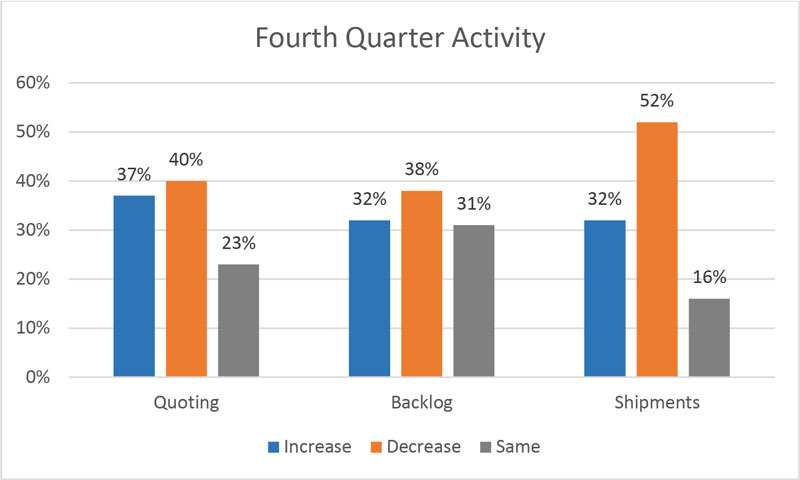

The industry entered 2018 with less momentum than previous years, as fourth-quarter quoting, shipment and backlog either remained stagnant or decreased for the majority of mold manufacturers. In the fourth quarter of 2017, only one-third of moldmakers reported increases in shipments – down more than 10 percent from last year. Quoting either remained the same or decreased for 63 percent of moldmakers in the fourth quarter, and backlog levels dropped for 38 percent of mold manufacturers (Chart 1). However, the slow fourth quarter may not necessarily be negative, as many moldmakers are shifting gears internally to become more competitive.

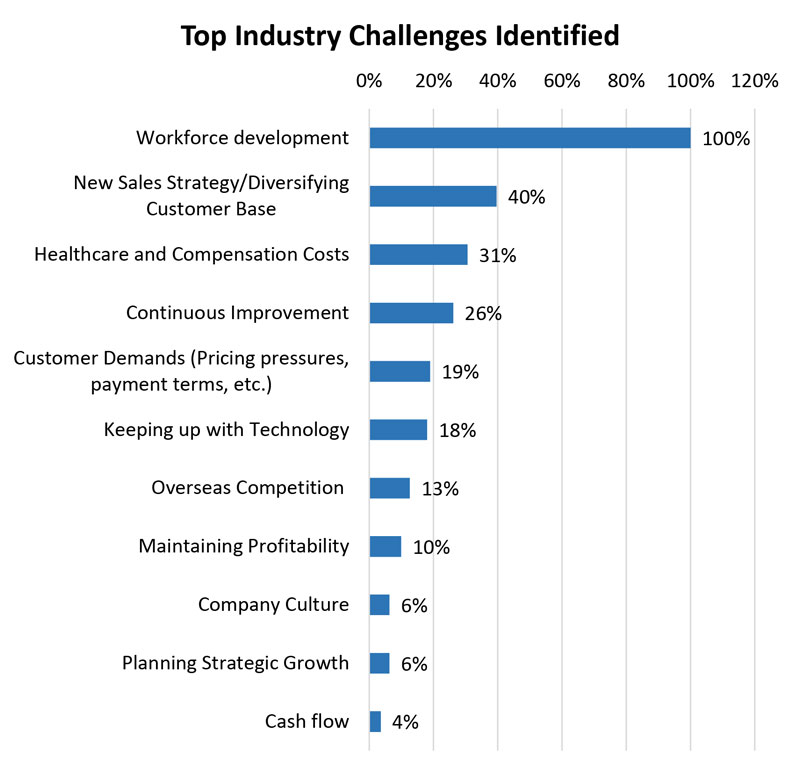

To no surprise, workforce development issues continue to plague the moldmaking industry, with 100 percent of executives indicating that recruiting, retention and training challenges are a top priority for their leadership teams in 2018 (Chart 2). This challenge may give insight as to why compensation and benefits costs and continuous improvement programs also topped the list of challenges for mold builders over the next 12 months. A tightened labor market across the US has left moldmakers feeling the pressure to offer more competitive wages and benefits to attract talent. This is likely one of the reasons that healthcare and compensation costs concerns jumped 14 percent from last year.

As healthcare and compensation costs are eroding moldmakers’ bottom lines, mold builders now are turning their attention to continuous improvement and capacity building initiatives. Twenty-six percent of moldmaking executives report that continuous improvement programs will be a major focus in 2018. A newfound concentration on continuous improvements may help to alleviate the time and costs associated with overcoming workforce development constraints.

The US moldmaking industry has long been concerned about the impact of offshoring in the manufacturing industry. Each year, executives attribute weakened or subpar profits to customers outsourcing their mold builds. Looking into 2018, the trend continues. This year, a record number of plastics processors reported going offshore for tooling production. However, the plastics industry also now is seeing reshoring trends for the actual molding. Moldmakers are beginning to evaluate their internal sales strategies and diversify their customer base. Forty percent of moldmakers reported that an emphasis on new sales strategy will be imperative to their leadership teams in 2018. Keeping a heightened focus on strategic sales and new customer acquisition will be key to the US moldmaking industry to compete with the allure of low-cost offshore toolmaking. It will be up to the mold manufacturers to find new ways to differentiate their organizations’ offerings to potential customers.

While 2018 may not be as robust as 2017, it will most likely be a steady year, as moldmakers begin to switch their focus to efficiency, capacity building and strategic sales. Mold builders that are able to dive into new markets – those focused on quality, not only price – and improve their internal processes will be positively positioning themselves as manufacturing starts to return stateside.

For more information or to purchase the complete report, visit www.amba.org.