by Ashley Turrell, industry benchmarking manager

American Mold Builders Association

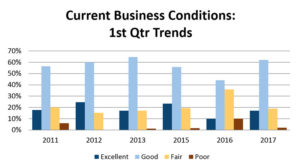

Heading into 2017, mold manufacturers were showing cautious optimism for their industry, particularly when compared to data from previous years, according to a study by the American Mold Builders Association (AMBA). Seventy-nine percent of participants in the study reported current business conditions as either good or excellent. Another 73 percent believed business activity would increase in 2017.

Market optimism

Forty-four percent of mold building executives believed the automotive sector will be the most optimistic market throughout 2017. The automotive market has experienced a seven-year sales growth, and many manufacturers are hoping this positive trend will continue for the next 12 months.

Forty-four percent of mold building executives believed the automotive sector will be the most optimistic market throughout 2017. The automotive market has experienced a seven-year sales growth, and many manufacturers are hoping this positive trend will continue for the next 12 months.

The second most optimistic market reported was the medical/dental/optical sector, according to 18 percent of respondents, followed by consumer products (nine percent) and the defense/military industry (eight percent).

Mold building industry challenges

Every executive who participated in this study reported workforce development challenges are plaguing their companies. Workforce development, which includes recruiting, training and retaining talented and skilled employees, has been a top challenge for the past several years.

Every executive who participated in this study reported workforce development challenges are plaguing their companies. Workforce development, which includes recruiting, training and retaining talented and skilled employees, has been a top challenge for the past several years.

Outside of workforce development, creating or improving a comprehensive sales strategy was the second largest challenge mold builders are focusing on throughout the next 12 months. This may be more important than ever before, as another 25 percent of participants reported that competition, both foreign and domestic, is a challenge for their executive team in 2017.

Profits

Compared to the third quarter of 2016, fourth quarter profits remained unchanged for 51 percent of mold builders. While only 29 percent indicated a fourth quarter increase in sales, this percentage is 13 percent higher than last year’s reported sales.

Even though 79 percent of survey participants are pleased about current business activity, only 56 percent reported that current profits were either acceptable or great. The reason for this may include the fact that customers are outsourcing out of the US, competition is cutting margins and customer demands for requirements and specifications are more difficult to meet than ever before.

Mold builders are investing in primary machines, equipment updates and auxiliary equipment to become more competitive and hopefully increase efficiency and overall profits in 2017.

Overall outlook

The number of mold builders reporting positive business conditions is up 17 percent from the previous year. A pulse survey conducted by the AMBA at the end of the first quarter also reported that the average mold builder is running at 75 percent capacity – while 21 percent are operating at 90 percent capacity or greater. Executive outlook and overall business performance are showing strong upward trends for the mold building community.

The Annual AMBA Business Forecast Report addresses a variety of economic indicator questions to provide an overview of the industry. Participants in the study received the report at no cost, and the report is available for purchase on the AMBA website. For more information, visit www.amba.org.