By Ashley Turrell, operations support specialist

American Mold Builders Association

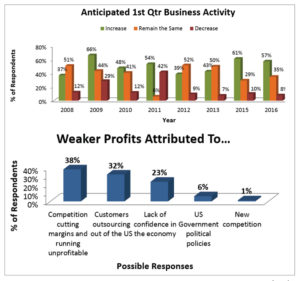

While fourth quarter trends were not as strong as in past years, steady business activity is predicted for mold building companies in 2016, with 92 percent of executives anticipating first quarter business activity to either increase or remain the same, according to the most recent Business Forecast report published by the American Mold Builders Association (AMBA).

For the past eight years, AMBA’s Business Forecast survey has retrieved and consolidated information on primary economic indicators from senior-level mold building industry executives to identify, track and predict trends. The results of this survey serve to help company business professionals benchmark how their company performance stacks up in comparison to industry norms and aids in calibrating and validating the intuitive “gut feel” they inherently possess about their own businesses.

For the past eight years, AMBA’s Business Forecast survey has retrieved and consolidated information on primary economic indicators from senior-level mold building industry executives to identify, track and predict trends. The results of this survey serve to help company business professionals benchmark how their company performance stacks up in comparison to industry norms and aids in calibrating and validating the intuitive “gut feel” they inherently possess about their own businesses.

According to this year’s report, executives hold optimism for the 1) automotive, 2) medical, dental and optical, and 3) consumer products. The automotive industry is the favorite industry segment due to the strong vehicle forecasts for 2016; the market areas touching medical and consumer products also are predicted to be the most promising arenas to experience growth over the next 12 months.

AMBA’s survey revealed that 30 percent of industry executives show optimism about the automotive industry. Chief economist of the National Automobile Dealers Association Steven Szakaly recently reported that “new light-vehicle sales will rise to 17.71 million units in 2016, a 2.3 percent increase from forecast of 17.3 million sales in 2015.”

The second most optimistic marketplace for 2016 is the medical, dental and optical segment, with 24 percent of executives seeing the potential strength in this industry. Supporting this prediction, Visiongain, a leading global business information company, recently reported that “the medical devices industry will witness significant opportunities for growth in the coming decade … driven by the introduction of innovative devices into the market and also by the demand generated by illnesses associated with the aging global population.”

Fourteen percent of executives anticipate the consumer products market to be strong throughout 2016. Companies have been experiencing growth in this industry as executives reported seeing consistent quoting in the consumer products market. However, consumer products also is ranked as one of the least optimistic markets by 14 percent of respondents. Industry leaders believe that the tumultuous global market, paired with a pressure to move manufacturing offshore, is hurting this segment.

While executives are optimistic for the coming year, 33 percent of respondents reported that profits were down related to three months ago, compared to just 13 percent in 2015. Current profit levels were only rated as “great or acceptable” by just over half of respondents; the other 48 percent reported profits as “weak to unacceptable.” These weaker profits were attributed to a number of factors, most common being competition cutting margins (38 percent), customers outsourcing out of the US (32 percent) and lack of confidence in the economy (23 percent).

These lower profit levels are coupled with the crippling challenge of managing customer specifications and requirements. Fifty-seven percent of executives responding to this year’s survey reported that customer specifications and requirements are more demanding than in the past, with four percent considering customer demands to be “unreasonable.” Only one percent of executives believe that customer specifications and requirements have become easier.

Alongside regular business issues, over three-fourths of executives (79 percent) reported finding and retaining skilled employees as the number one challenge throughout 2016 – dwarfing all other issues. The aging workforce and attracting today’s youth to the industry continue to increase in difficulty, leaving many companies in a constant search for talented workers.

Along with the workforce challenges, executives are focused strongly on the task of attracting new business and new customers, with 30 percent of respondents seeing this a top challenge. Mold building companies also continue to feel the effects of changing government regulations, especially in regard to the Affordable Care Act. Finding the most cost-effective health care for employees ranks third in concerns for companies going into 2016.