By Laurie Harbour, president and CEO

Harbour Results, Inc.

Looking across the tool and die industry over the past six months, many shops have experienced a significant slowdown. According to data collected by Harbour Results, Inc., capacity across North American mold shops was at 66 percent in the first quarter of 2016.

Why has the industry been slow?

This trough can be attributed to a couple of key factors. First, there are a significant number of jobs on hold in the automotive industry. This likely is due to the fact that many automakers are postponing program launches or are experiencing program delays due to late changes in design and processes as they search for efficiencies and cost savings based on manufacturing, mold or tool-build feasibility. Additionally, delays also could be attributed to automakers’ need develop new innovations to meet upcoming CAFÉ standards, which require an improvement in fuel economy and a reduction in emissions.

Second, sales are flat across a number of industries. Heavy-duty truck industry sales have significantly slowed, and there is excess inventory on hand. Similar trends are seen in home appliance, construction equipment and aerospace, which are impacting investment in product development and design, and delaying new product introductions.

However, we predict this slowdown to be temporary. Looking at the US economy, a number of factors support a positive outlook for mold makers, including falling commodity prices and lower oil and gas prices. Also, the automotive industry, for example, is predicting a number of upcoming vehicle launches. Based on recent LMC Automotive forecasts, the automotive industry will see new vehicle launches remain high, with 49 and 39 launches predicted for 2018 and 2019, respectively. A large majority of these new vehicle launches are expected to be sourced in the second and third quarter of this year, based on the average lead time needed for tool development. Additionally, automakers will be pushing to launch new vehicles that will meet CAFÉ regulation milestones.

When asked, North American mold shops predict capacity to move up to 78 percent by third quarter 2016. The launch and capacity forecast, coupled with what the Harbour Results team is seeing on shop visits and hearing from mold shop owners, indicates that mold shops will see a significant uptick in business in the second half of 2016 and into 2017.

That said, based on history and the cyclical nature of the business, it is safe to say that mold shops will continue to experience future capacity and revenue peaks and valleys.

What should mold shops do to manage the highs and lows?

Oftentimes, mold shops look to their operational efficiency to help balance the business, and this is an important part of the puzzle. However, the best way to maintain balance is working on the front end of the business.

Harbour Results’ Business Assessment, which analyzes a company’s total operation, including program management, quality, materials, engineering, sales and marketing, management, operations, human resources, financials and administration, indicates there is a great deal of opportunity for improvement in sales and marketing. Based on data collected through mold shop assessments from 2013 through 2015, there has been a modest drop in sales and marketing assessment scores. More concerning, mold shops under $10M in revenue have seen a more drastic drop of nearly 15 points in the average score. And, for a shop to compete in today’s market, effective sales and marketing must be part of the mix.

To help level out the effects of the peaks and valleys found in any business, companies need to develop a strategic sales process.

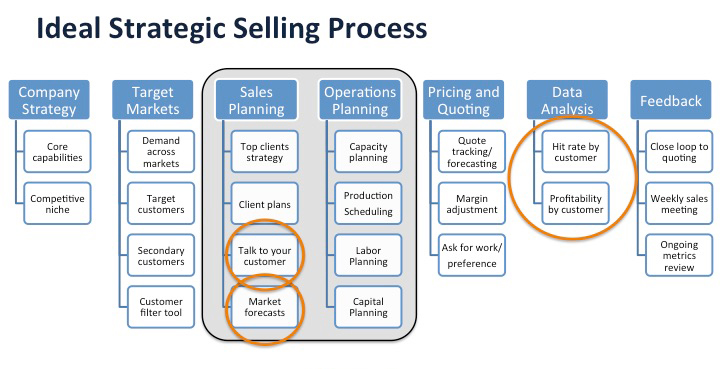

A successful sales process has seven steps – Company Strategy, Target Markets, Sales Planning, Operations Planning, Pricing and Quoting, Data Analysis and Feedback. Today, mold shops very rarely utilize all seven of these steps, or these steps are implemented informally within the organization.

How does a company get started building this sales process?

A good spot for mold builders to start is with data the company already collects. To develop a process, it is important for leadership to understand the current state of the business. For example, doing an analysis on the company’s current request for quote (RFQ) hit rate data across customers, jobs, type of work, etc., could provide insights that may help drive strategy.

Hit Rate Analysis – Number of quotes per customer, number of quotes won per customer, total value of the business won and total value of the quotes requested.

During the analysis, companies can uncover which customers create the most business and those from which it rarely or never wins business, while also determining if the shop’s business is appropriately diversified among customers and/or industries. Once a company analyzes the RFQ hit rate data, it will be able to identify its own unique set of sales opportunities and challenges.

In addition, companies need to gather and review data from the markets they supply. This market data can come from multiple locations and will assist in identifying future quote options, as well as help to predict the quote and build timeline. For example, mold builders serving the automotive industry can use launch forecasts from LMC Automotive or other market data providers.

These data also can be utilized to develop ideal quote volumes to achieve a company’s revenue goals. By understanding the RFQ hit rate and the average revenue per quote won, a mold shop can identify the number quotes per month (year) needed to achieve its revenue goals. Also, by monitoring quote volumes, a business will be able to more accurately predict future capacity of its shop and align operations to the customer demand.

Finally, when looking at a company’s sales process, it is important to secure customer feedback. Mold shops need to talk to their customers. It might seem like an obvious part of the sales process, but all too frequently, companies do not take advantage of the opportunity to communicate with customers to exchange information, better understand their needs and ask for additional business. Utilizing the two pieces of hard data – RFQ hit rate and market data – along with direct interactions with the customer, mold shops will better be able to build sales plans for its target customers.

Establishing and implementing a sales process is a critical component of leveling out the business highs and lows. However, it also is important to not lose sight of maintaining operational efficiencies. To optimize a shop’s profitability and avoid the trough, demand (sales) must be matched with supply (operations). To do this, leadership must be committed to the process, invest in the resources needed for sales and operations and utilize data to support strategic planning and decision making.

Laurie Harbour is president and CEO of Harbour Results, Inc. Combining operational and financial advisory expertise with industry analysis and thought leadership, Harbour Results delivers results that impact the bottom line. The company specializes in manufacturing, production operations and asset-intensive industries, as well as a number of manufacturing processes, including stamping, tooling, precision machining and plastics. For more information, visit www.harbourresults.com.